Battling poverty with finance

Economic policies, innovative lending help lift millions out of dire straits

Around supper time one evening this winter, machines at a tea factory in Xiadang, a small village surrounded by mountains in north Fujian province, were still rolling. Workers were busy packaging and transporting tea products into the warehouse.

It appeared as though they considered work is worship, and were grateful to be able to work at all.

The tea factory, nearly 1,600 square meters, was built in 2014, with an initial investment of about 4 million yuan ($615,384). Part of that was borrowed from local banks at relatively lower interest rates.

Measures like these were what the annual Central Economic Work Conference in December highlighted as key to winning what central authorities call "the three tough battles". To wit: targeted poverty alleviation, prevention and defusing of major risks, and pollution control.

To win the battle against poverty, policymakers pledged top-quality efforts with focus on helping special groups and eradication of abject poverty.

Xiadang is a shining example of how the central bank's supportive policy is helping China to achieve the goal of "poverty reduction".

In Xiadang, workers pluck tea leaves from a 40-hectare village plantation built by the local government. The plantation is again a result of cheaper loans, a project to lift the poor villagers out of poverty.

Lending interest rates of these special loans were 10 to 20 percent lower than normal. That has helped transform Xiadang, which was formerly a poverty-ridden village.

In 2013, Xiadang villagers' annual per-capita disposable income was just 4,600 yuan. By 2016-end, however, it rose 160 percent to more than 12,000 yuan, thanks to dividends flowing from the shares of the tea gardens and factories that they owned via the stock options route.

Zeng Shoufu, the first secretary of the Party group in Xiadang, said that 27 of the 32 poor families in the village were lifted out of poverty by 2016, thanks to the development of the tea production industry.

Xiadang is not a case in isolation. Across China, thousands of such places are better off now on the back of customized financial services aimed at poverty reduction.

The basic strategy is to facilitate the development of some industries fit for local environmental conditions through easier credit.

Bankers around the world have noticed that many people from poor areas cite lack of access to credit as one of the main constraints on local economic growth.

A recent study by the International Monetary Fund showed that more than 2 billion people worldwide are still unbanked, with most of them in developing countries like China.

It found that greater financial inclusion, which means availability of financial services for a broad group, can make a 2 to 3 percentage point difference in economic growth.

According to the World Bank's definition, financial inclusion means that individuals and businesses have access to useful and affordable financial products and services that meet their needs-transactions, payments, savings, credit and insurance-delivered in a responsible and sustainable way.

The bank said more than 200 million micro, small and medium-sized enterprises in both formal and informal sectors of emerging economies, including China, lack adequate financing to grow and thrive.

To remedy the situation, China's top policymakers have been underlining the importance of developing inclusive finance. The State Council, the country's Cabinet, issued a five-year plan in January 2016 to push forward the development of inclusive finance by 2020.

Small and micro-sized enterprises, farmers, low-income groups in urban areas and people in poverty are key targets of inclusive finance policies. They aim to improve coverage rate, availability and satisfaction from financial services.

The People's Bank of China, the central bank, has taken measures in terms of monetary policy to encourage bank lending to small and micro-businesses and the agricultural sector. It has also increased re-lending to commercial banks to support less-developed areas and reduce financing costs.

In Fujian province, by the end of October 2016, total outstanding loans to the agricultural sector reached 1.24 trillion yuan, accounting for almost 30 percent of the total bank lending. That to small and micro-enterprises was 789.88 billion yuan, up by 11.48 percent from a year earlier.

Meanwhile, lending for targeted poverty reduction was 15.58 billion yuan, up by 178.02 percent year-on-year, according to the PBOC's branch in Fuzhou.

Shan Qiang, president of the branch, said, "Development of financial inclusion and increase in financial support for poverty-stricken areas constitute the most effective way to support the development of real economy, which is one of the important measures to reduce poverty."

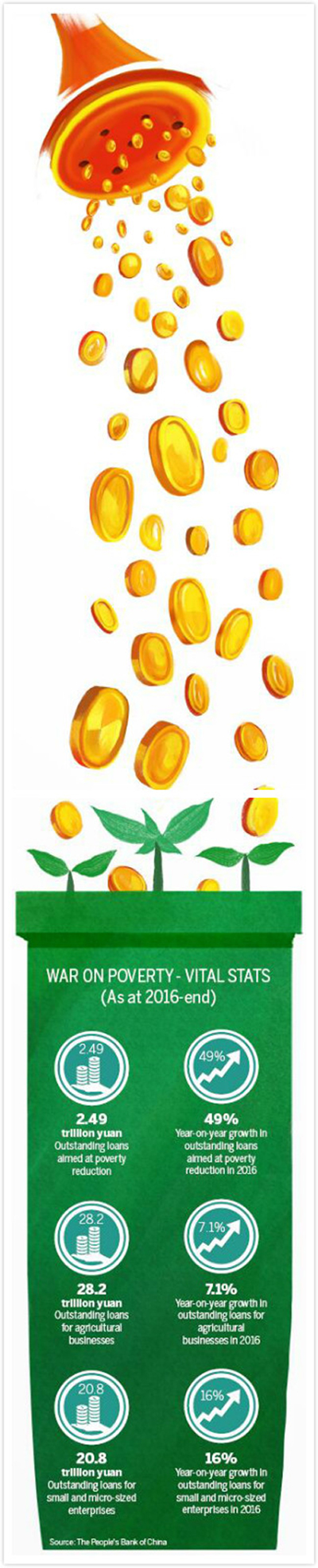

According to a central bank report, total outstanding loans for targeted poverty reduction rose to 2.49 trillion yuan as at 2016-end, up by 49 percent from 2015, compared with 28.2 trillion yuan in loans for agricultural activities, a growth of 7.1 percent year-on-year, and 20.8 trillion yuan in loans for small and micro-businesses, a growth of 16 percent year-on-year.

This year, the PBOC will cut the cash amount that needs to be set aside as reserves, or the required reserve ratio, by some financial institutions that have extended loans to support small and micro-sized enterprises, startups and agriculture.

This policy will offer commercial banks targeted RRR cut of 0.5 to 1.5 percentage points if their annual outstanding loans or new loans in inclusive finance reach certain requirements.

The three-day Central Economic Work Conference, which concluded on Dec 20 last year, has targeted "poverty reduction" as one of the three policy priorities in the next three years.

Yi Gang, the central bank's vice-governor, reiterated recently that development of inclusive finance can help in achieving the "final victory" in the country's poverty reduction battle, which will be one of the primary tasks of the PBOC in 2018.

"China has made significant progress in financial inclusion," said the IMF in a report, after it assessed the country's financial sector performance during the past five years. "High levels of account penetration, savings, and usage of payments services have been achieved."

The IMF recognized that the financial system has facilitated China's high growth rate and the consequent sharp decline in poverty rates. "The sector now reaches most of the population, as evidenced in financial inclusion measures, and permeates virtually all aspects of economic activity," it said.