China in 2019 : Getting the stimulus dosage right

Standard Chartered Bank maintains its 2019 growth forecast of 6.4 percent for China, above market consensus. The Chinese economy faces downward pressure from sluggish credit growth, a possible property market correction, and trade frictions with the United States.

We estimate that full implementation of announced US tariffs (25 percent additional tariffs on $250 billion worth of Chinese products) — which we think is still likely despite the recently agreed tariff truce — would lower GDP growth by 0.6 percentage point.

Yet the Chinese government remains committed to its goal of doubling 2010 GDP by 2020, and may set a growth target of 6.0-6.5 percent for 2019. In fact, policy support has been introduced to contain the downturn, and we believe the government can meet the target.

A turnaround likely in fourth quarter

External headwinds are likely to push China’s current account into a full-year deficit in 2019, the first since 1993. China registered a year-to-date deficit in the first three quarters of this year. However, assuming a turnaround in the fourth quarter, we expect a marginal annual surplus. While export growth may slow down next year due to the impact of US-China trade conflict, imports are likely to remain resilient amid policies to encourage imports (including general tariff cuts) and stimulus measures aimed at boosting domestic demand.

We forecast an annual current account deficit of 0.5 percent of GDP in 2019. In subsequent years, China’s current account may swing between surplus and deficit, an indication that the currency is close to fair value.

Besides, consumption and investment are likely to moderate the downtrend, with policy support, while urbanization, an aging population and the rise of the middle class will continue to drive consumption in the longer term. In the near term, the individual income tax reform will significantly reduce the tax burden on low-income households, which have a higher propensity to consume.

Policy, public finance playing first fiddle

The authorities have refrained from massive stimulus so far. In addition, the survey-based unemployment rate has remained relatively low at around 5 percent this year, making “bazooka-type” policies unnecessary, and the government appears mindful of the side effects of excessive stimulus, and does not appear to want to trigger a strong rebound.

The effects of spending increases and tax cuts are likely to become more tangible in the months ahead, and the 2019 budget may provide flexibility to handle both upside and downside risks. Special bond issuance has been 0.5 percent of GDP higher this year than in 2017, allowing local governments to boost infrastructure investment in the fourth quarter of 2018 and the first quarter of 2019.

We estimate that the May 2018 value-added tax cut and the October 2018 individual income tax reform will reduce the tax burden by nearly 1 percent of GDP. We expect the government to increase the official budget deficit to 3 percent of GDP in 2019 from 2.6 percent this year to allow for further VAT cuts. We also expect the People’s Bank of China, the central bank, to cut the reserve requirement ratio (RRR) by 200 basis points by the end of next year to prevent a tightening of monetary and credit conditions.

As the authorities shift their focus from deleveraging to stabilizing leverage, the central bank appears to be targeting money and credit growth in line with nominal GDP growth (of about 10 percent). As the central bank’s balance sheet stops growing, broad-based RRR cuts will be needed — along with measures to unclog the policy transmission mechanism — to keep its policy stance close to neutral.

Selective easing of property-market restrictions is likely in case macro policies prove insufficient to arrest the downturn. Potential housing demand in large cities remains strong, but is being suppressed by unprecedented restrictions. The relaxation of purchase and lending restrictions could quickly boost home sales and investment, although the government would be wary of the risk of fuelling property bubbles.

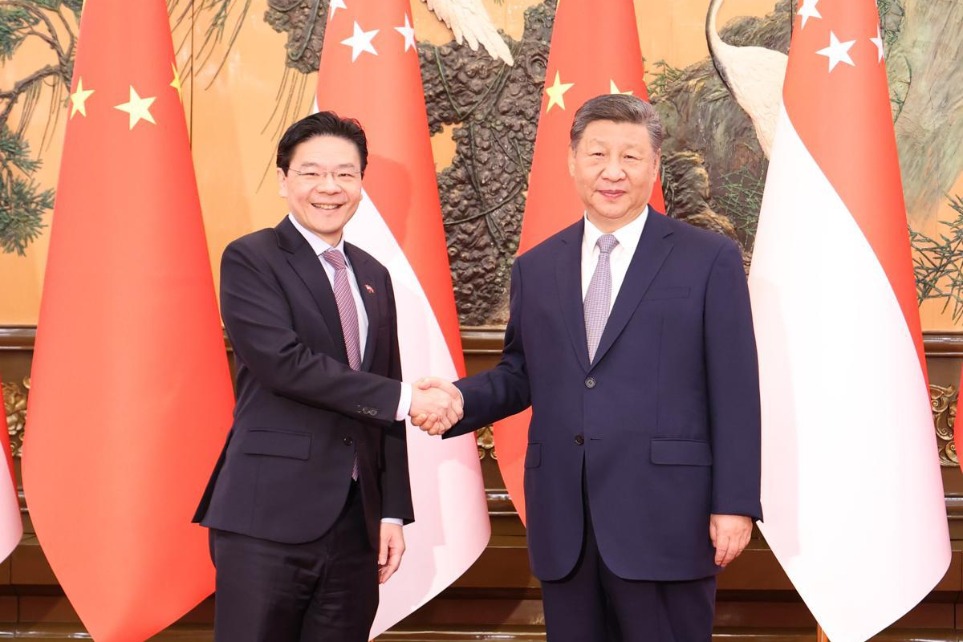

A bumpy ride ahead for US-China ties

And although tensions between the US and China go beyond trade issues and their strategic rivalry foreshadows difficult relations in the long term, common interests should prevent a one-way deterioration in bilateral ties.

Following the US midterm elections, we see intentions on both sides to prevent frictions from escalating further, as the cost of economic decoupling would be high for both countries. The probability of an easing of trade tensions next year appears under-priced, in our view, although further tensions are likely in the run-up to the 2020 US presidential election.

The author is chief economist of Greater China and North Asia Standard Chartered Bank.