Trade row's impact on 2019 growth declines

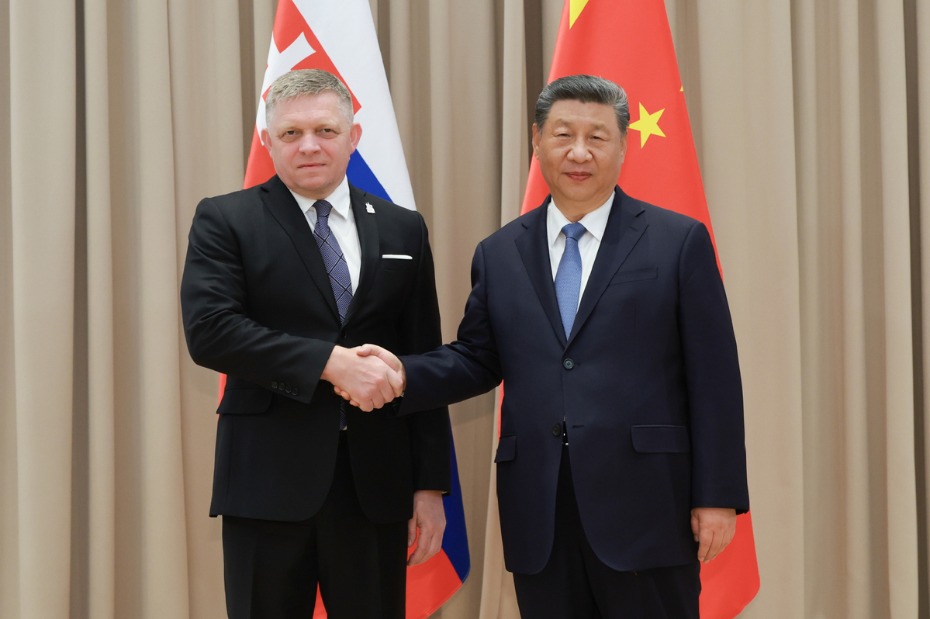

In light of the (temporary) ceasefire of the US-China trade conflict following the meeting between President Xi Jinping and his US counterpart Donald Trump on Dec 1, we now expect a less sharp slowdown in China's export and GDP growth in the first quarter of 2019. A mutual understanding of a stable RMB exchange rate to US dollar is likely an important part of any trade deal, and as such, we expect to see RMB to US dollar hovering around 7 for longer. China's domestic policy mix may pivot somewhat as well.

We revise China's 2019 GDP growth forecast from 6.0 percent to 6.1 percent.

While we do not expect the two sides to reach a grand deal before March 2019, we think the probability of further delays in additional tariffs as the two sides negotiate beyond March 1 has significantly increased. As a result, the full year export growth to be slightly stronger than forecasted earlier. Imports will also be slightly stronger than expected earlier, helped in part by expected additional tariff cuts.

Although the Dec 1 meeting held off further tariff increases for now to allow time for negotiations, risks of trade conflict escalation remain significant. That said, these probabilities may change drastically before March, as many factors, including US plan to restrict more tech exports to China and its actions against major Chinese tech companies (see Huawei CFO detained; After ZTE, what next; Pandora's box), may complicate trade negotiations.

We expect more market reform and continued policy easing. Despite the better-than-expected outcome on Dec 1, we think China's existing and planned policy easing will continue to be implemented. The policy easing is partly an adjustment to earlier credit and quasi-fiscal tightening, and partly to offset trade headwinds. A delay in tariff increase (and potential easing of trade tension) will likely give the Chinese government some time to prepare for additional policy responses and reduce the urgency for a bigger stimulus.

We estimate the credit growth will rebound to about 11 percent in 2019 and infrastructure investment will grow by about 10 percent. More importantly, in accordance to China's long-term plan and as part of the trade negotiation, we think the Chinese government tilts policies a bit more towards market reform in the annual Economic Work Conference and commemoration of the 40 year anniversary of China's "reform and opening-up". Additional corporate tax cuts, SOE reform measures may be taken, and the market could be further opened to private and foreign investors.

Although there were no reports on discussions about exchange rate during the Xi-Trump meeting, we believe a mutual understanding on the issue is likely an important part of any trade deal. As a result of delayed tariff increase, sentiment on RMB has improved somewhat.

In 2019, disappearing external surplus (we now expect current account surplus to narrow from 0.4 percent of GDP in 2018 to 0.1 percent in 2019), shrinking China-US rate differential, and trade conflict related concerns will likely put more depreciation pressure on RMB. On the other hand, a de-escalation of trade tension and weakening of the US dollar will help support RMB. As a result, we now expect exchange rate of RMB to US dollar hover around 7 in 2019, before trading at about 7.2 at the end of 2020.

The author is head of Asian economic research and chief China economist with UBS. This is an excerpt from the 2019 outlook report of UBS.