Re-listings bode well for A-share investors

A series of high-profile secondary listings of technology companies such as JD and NetEase in Hong Kong this year appear to have created a mistaken belief-that most of the Chinese stock issuers facing a potential delisting threat in the United States will seek refuge in the Hong Kong stock exchange.

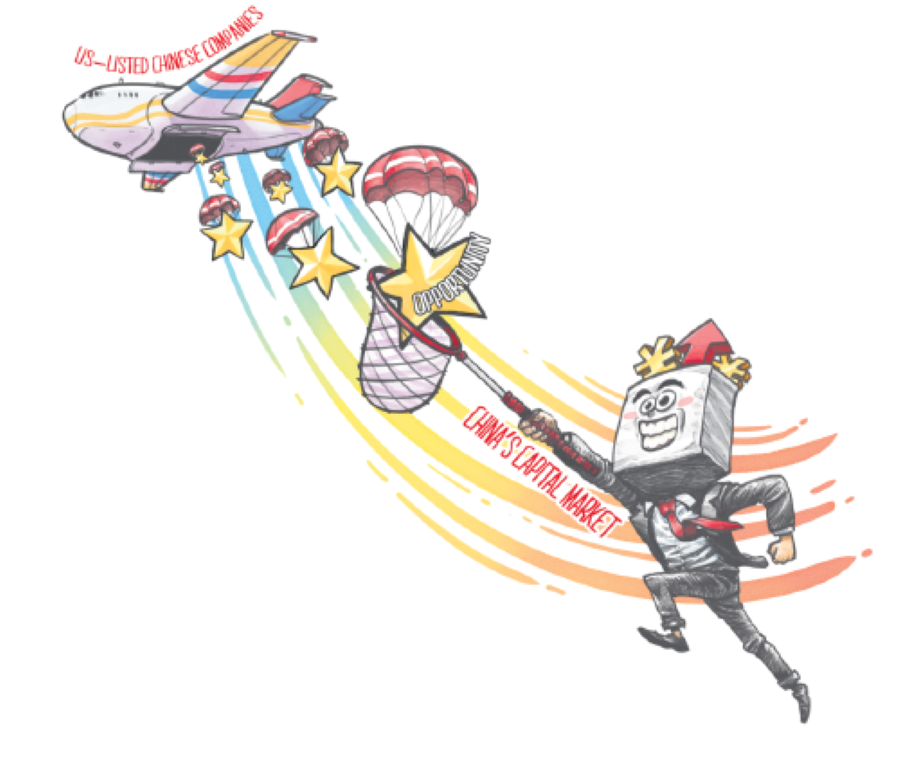

Indeed, secondary listings in Hong Kong have become the main channel for qualified US-listed Chinese companies returning home for finance so far. But, increasingly, more medium-and small-cap Chinese issuers will instead seek to re-list on the mainland stock markets in the future.

This would be a trend decided by the difference in valuation levels of Chinese firms in the US and mainland markets, as well as China's capital market reform and opening-up measures in place. Investors should get prepared for the strategic investment opportunities brought by the potential wave of re-listings.

Ever since Luckin Coffee Inc owned up to its financial misreporting in April, the US government has ratcheted up delisting threats against Chinese issuers.

Most recently, the US House of Representatives passed a bill on Wednesday, which proposed to delist Chinese companies from US stock exchanges if they did not comply with local auditing rules for three years in a row.

The China Securities Regulatory Commission, the country's top securities regulator, has proposed a joint inspection mechanism over audit firms as a solution, with the latest version of the proposal sent to the US side in August.

The CSRC said the US Public Company Accounting Oversight Board has confirmed receipt of the proposal and would examine it in due course. But, formal talks over the issue have not been announced and regulatory uncertainties remain.

The protracted uncertainties have propelled the string of secondary listings on the Hong Kong bourse of US-listed Chinese firms such as JD and NetEase in June.

On the heels followed listings of hotel chain Huazhu Group, restaurant operator Yum China, courier company ZTO Express, and education organization New Oriental Education& Technology Group.

By virtue of easy and clear market access and similarities with the US stock markets, Hong Kong by far has become the main destination for US-listed Chinese firms seeking shelter closer to home.

In contrast, the mainland A-share market has only seen the re-listing of chipmaker Semiconductor Manufacturing International Corp or SMIC in July, after it delisted from New York last year.

But a lot more cases should come out at a fast clip.

On the one hand, improvements in listing rules at mainland bourses have paved the way for US-listed Chinese firms to return home for re-listing, with the channels proven to be smooth by several initial public offering cases for red-chip firms this year.