Fiscal policy key to growth next year

China's macroeconomic indicators set to improve in 2023, report says

China must further strengthen the implementation of a proactive fiscal policy next year to underpin economic recovery despite many ongoing challenges, experts said.

In 2023, the Chinese economy will enter a period of transition to replace old growth drivers with new ones. The internal and external environment of economic development may improve. In addition, the country may continue to optimize COVID-19 prevention and control measures. This is conducive to the gradual recovery of production and will help revive the real estate market step by step, said a report recently published by the BOC Research Institute.

Due to these factors and the low base effect this year, China's macroeconomic indicators are expected to improve next year. To what extent the economy will recover depends on continuous optimization of COVID-19 control measures and the level of recovery of domestic market demand and market confidence, the report said.

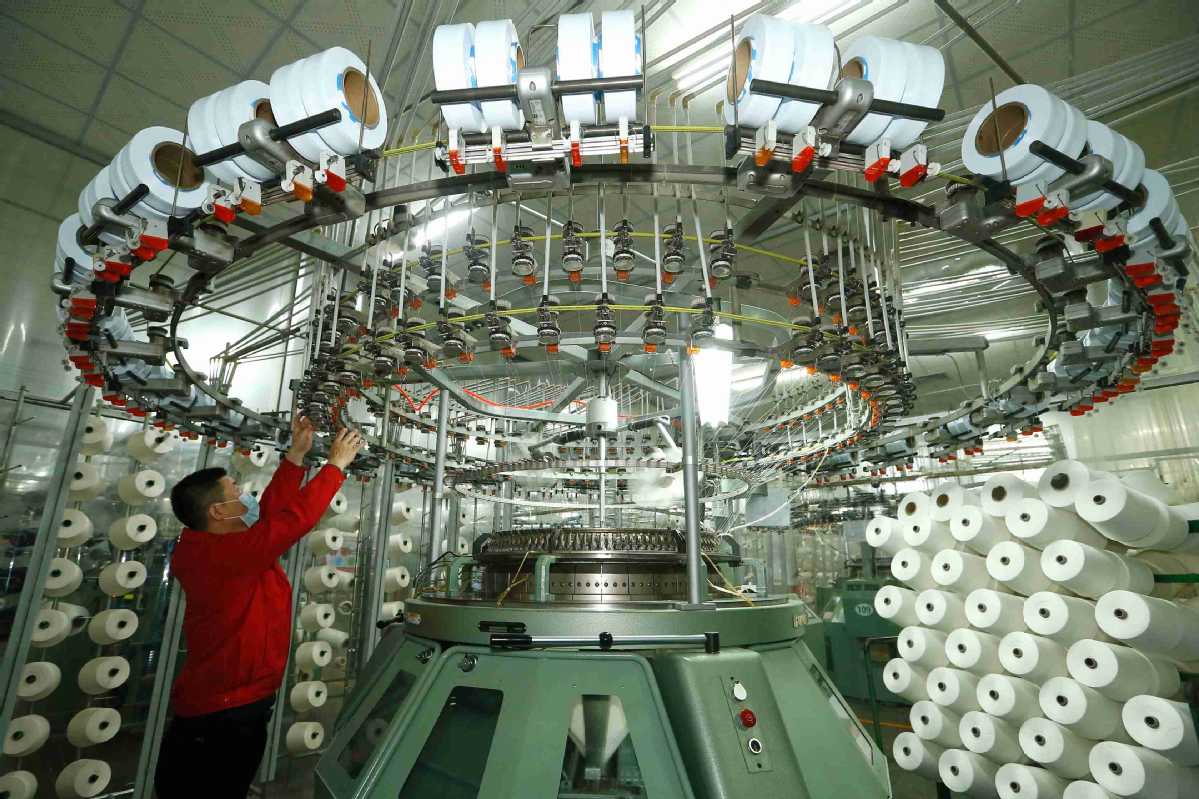

China's fiscal policy will remain a key mechanism to bolster economic recovery next year. On the one hand, the country should highlight the importance of stabilizing employment, extend policies on tax cuts and refunds as well as fee reductions appropriately, and continue promoting the recovery of the real economy, especially micro and small enterprises. On the other hand, it is necessary for the government to expedite actions on rural vitalization, technology enhancement, and the construction of a modernized industrial system and major infrastructure projects.

Considering that China will have a tremendous demand for growth stabilization and a large amount of debt will mature in 2023, researchers at the BOC Research Institute suggest policymakers consider raising the target deficit-to-GDP ratio for next year to 3 percent or more, up from around 2.8 percent this year.

Lian Ping, chief economist at Zhixin Investment and head of the Zhixin Investment Research Institute, said China should step up its proactive fiscal policy next year and may need to raise the target deficit-to-GDP ratio to 3.2 percent or more. It is necessary for the country to keep fiscal expenditure at a reasonable scale and further optimize the structure of government expenditure.

Lian advised policymakers to set a 2023 quota of more than 3.5 trillion yuan ($501.5 billion) on special-purpose bonds for local governments, which is roughly the same as the quota of 3.65 trillion yuan this year, thus continuously giving play to the role of infrastructure investment in spurring expansion of demand. The government could also increase disposable household incomes through the adoption of policy instruments to stabilize consumption growth.

From the end of this year to next year, the People's Bank of China, the central bank, may explore new areas to use structural monetary tools. It may consider setting up a special relending facility to encourage commercial banks to issue consumer loans at lower rates in order to promote interior design, travel and purchases of furniture and home appliances, he said.

If the US Federal Reserve slows down the tightening of its monetary policy, China will have greater leeway to further ease its monetary policy next year on the basis of a prudent stance. The PBOC may further cut the reserve requirement ratio for banks and key lending rates if the occasion arises, he said.

Xiong Yi, Deutsche Bank China chief economist, recently published an outlook report on China's macroeconomy in 2023. The key presumption for the outlook is that China will further ease its COVID-19 policy.

Reopening will likely help boost housing demand. Property policies have already eased substantially and are no longer constraining the recovery. Housing affordability has also improved, and households have increased savings and reduced debt levels, Xiong said in the report.

"We forecast China's growth to rebound from 3 percent this year to 4.5 percent in 2023 and 6.5 percent in 2024," he said.