Financial openness can help drive economy

The Central Financial Work Conference, held from Oct 30 to 31, highlighted the importance of building a nation with a strong financial sector at a faster pace and promoting high-standard financial opening-up to better ensure the country's financial and economic security while also steadily fostering renminbi internationalization.

The promotion of high-level financial openness is a significant component of China's open economic system in the new era, as the country has made full use of openness to drive reform and development in its economic and social undertakings.

It was stressed, therefore, that excessive haste and needless delays should be avoided while carefully balancing the pace and intensity of high-standard financial opening-up.

Against the backdrop of ongoing global challenges due to COVID-19 and a rapidly changing world order, there has been a growing emphasis on security over efficiency in the international division of labor, accompanied by various discussions and actions related to de-globalization and de-risking.

In this context, the conference proposed the promotion of high-standard financial opening-up to steadily expand institutional opening-up in the financial sector and enhance cross-border investment and financing facilitation.

This approach not only serves as a robust counter to the anti-globalization sentiment, but also complements the development of a new open economic system on a higher plane.

Furthermore, the conference stressed the urgent need to step up risk mitigation in the financial sector, calling for efforts to maintain stable operation of the financial market, prevent risks from migrating across regions, markets and borders as well as strengthen foreign exchange market management while keeping the RMB exchange rate broadly stable at a reasonable, balanced level.

Global experience indicates that the complexity of financial regulation and supervision rises along with increased potential risks due to greater financial openness and capital account convertibility.

The risks of cross-border capital flows and RMB exchange rate fluctuations were highlighted. As financial openness gradually extends from long-term to short-term capital such as securities investments like stocks and bonds, the marketization of the RMB exchange rate continues to deepen, leading to frequent deviations from market fundamentals.

In general, currency depreciation encourages capital inflows and stifles capital outflows, thereby keeping cross-border capital movements generally stable. However, when bandwagon effects emerge, currency depreciation can lead to larger-scale capital outflows, thus affecting domestic financial stability.

Meanwhile, the risks of speculative activity on domestic financial assets by overseas speculators cannot be overlooked. China's cross-border capital flows and the RMB exchange rate are significantly influenced by foreign capital as the country's stock, bond, foreign exchange, currency and commodity markets become increasingly open.

Financial openness, on the other hand, suggests that there is a greater likelihood of international financial hazards spreading domestically as the linkage between domestic and foreign capital markets and asset values strengthens.

Moreover, the ability of domestic investors to participate in global resource allocation faces challenges. Compared to full-fledged Western financial markets, China's financial market still lags behind in terms of size, internationalization level and infrastructure.

In addition to lacking investment and financing experience, domestic entities have a limited awareness of the legislation governing foreign financial markets. It becomes more difficult for domestic businesses to use asset allocation as an effective risk buffer when the investment climate deteriorates.

China's commitments to financial opening-up should be delivered in an approach that pursues progress while ensuring stability. To this end, efforts should be made to keep the pace and intensity appropriate while ensuring risk prevention at the same time.

As a vital component of expanding two-way financial market opening and an indication of China's growing global influence and overall strength, the promotion of RMB internationalization should be pushed ahead with diligence and prudence.

A report released by the People's Bank of China, the country's central bank, stated that in the first quarter, the RMB internationalization index increased by 10.2 percent year-on-year to 3.26. Major international currencies like the US dollar and euro are all valued much higher than the RMB, with their index standing at 57.68 and 22.27, respectively.

This shows that there is still a significant gap in the level of RMB internationalization compared to other major international currencies, indicating that there is still a long way to go before the RMB is truly deemed as internationalized.

Making the best of both domestic and international markets and resources, actively participating in global economic and financial governance, and strengthening coordination of macroeconomic policies among major economies are all necessary steps to strike a delicate balance between increasing openness and preventing and controlling risks.

In order to effectively manage financial risk levels, it is imperative to continuously improve the management of cross-border capital flows as well as the response protocols to deal with internal and external shocks. This is contingent upon the promotion of high-level financial liberalization.

Financial innovation should be fully leveraged to develop a database system and strengthen the payment and clearing systems, so as to bridge the gaps in financial infrastructure and help China play an active role in global financial and digital governance. Meanwhile, financial supervision should be strengthened under the current financial regulatory framework.

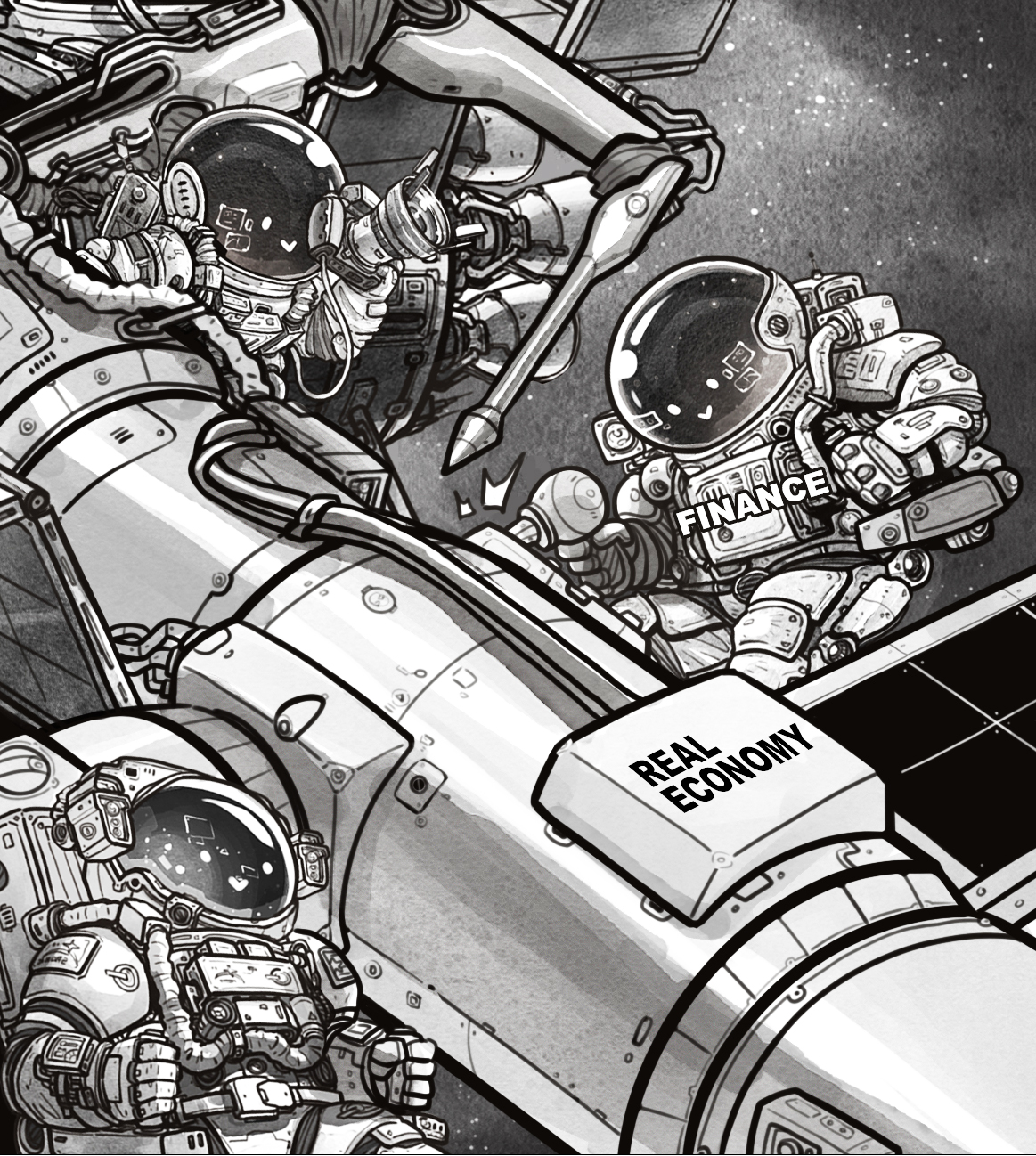

In particular, efforts to deepen supply-side structural reform in the financial sector should be high on the work agenda so as to better underpin the real economy and prevent and resolve financial risks.

It is essential to enhance the multilevel financial market system, fortify the foundational framework and workings of the financial market, optimize the financial institution system, refine the modern financial enterprise system with Chinese characteristics, and push forward the opening-up of capital projects of high quality in a well-paced manner.

Moreover, in line with the RMB internationalization process, it is imperative to support the development of a higher-level policy framework for integrated local and foreign currency pooling, as well as to improve the unified management, expansion and upgrading of this practice.

In an effort to maintain a stable foreign exchange market, the importance of further refining its market-driven exchange rate formation mechanism must be emphasized, to ensure that market supply and demand play a decisive role in determining the exchange rate.

Meanwhile, comprehensive measures will be implemented to anchor market expectations and prevent excessive fluctuations in the forex market.

Institutional opening-up of the domestic financial market in terms of rules, regulations, management and standards must be gradually scaled up to better align with international standards.

The current management model of pre-establishment national treatment and negative lists should be further enhanced, and the arrangements for policies pertaining to foreign-funded financial institutions should be optimized upon their entry into the Chinese market.

The above measures will help maintain the continuity and stability of openness, foster a stable, transparent and predictable policy environment for foreign investment, and attract foreign financial institutions and long-term capital to China.

In order to better serve the real economy, efforts are required to strengthen the provision of quality financial services and establish a service network covering countries involved in the Belt and Road Initiative.

To further support China's going-global initiative and the BRI, the RMB internationalization should take advantage of the opportunities presented by the multipolar development of the international monetary system.

To improve Shanghai's international financial center's competitiveness and influence, concrete actions need to be implemented. Meanwhile, measures to strengthen and solidify Hong Kong's standing as a global financial hub should be taken to increase the connectivity of the Hong Kong and Chinese mainland financial markets.

The views do not necessarily reflect those of China Daily.

Guan Tao is global chief economist at BOC International. Yin Gaofeng is a postdoctoral fellow at the School of Economics and Management, which is part of Beihang University.