Retail sales surge points to strong resilience

China's retail sales rose in May at the fastest pace since late 2023, while industrial production and investment posted steady gains, signaling the strong resilience of the world's second-largest economy amid persistent global headwinds.

Analysts said the growth points to a recovery that remains on course, backed by targeted stimulus and accommodative macro policies. However, lackluster demand and external uncertainties are fueling calls for more decisive and coordinated policy support.

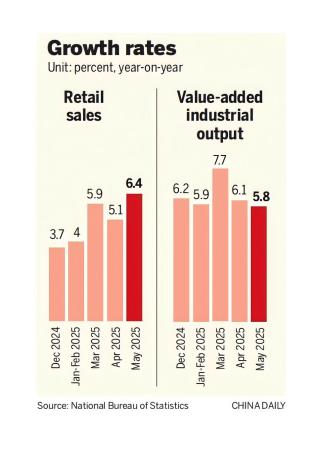

Figures released on Monday by the National Bureau of Statistics show that China's retail sales, a key measure of consumer spending, grew 6.4 percent year-on-year in May compared with a 5.1 percent rise in April.

"Consumers found a bit of retail therapy in May, helped along by the early start of the '618' shopping festival and incentives from the government's trade-in program," said Louise Loo, lead economist at British think tank Oxford Economics.

With the data seen so far, Loo said that her team believed China's second-quarter GDP is on track for 5.2 percent year-on-year growth.

"That is a touch higher than our current baseline, reflecting more exuberant export-frontloading and a services sector that has broadly held up. As such, we will likely nudge our forecast upward in the forthcoming forecast round."

Gathering steam

Loo's views were echoed by Ming Ming, chief economist at CITIC Securities, who said that China's economy is gathering further steam despite lingering external uncertainties, with more proactive and effective macro-economic policies taking hold.

"Industrial output kept recovering, consumption rebounded at a faster pace, and investment in manufacturing and infrastructure remained solid, further reinforcing the foundations for economic recovery," Ming noted.

NBS data also showed that China's value-added industrial output rose 5.8 percent year-on-year in May, while fixed-asset investment increased 3.7 percent during the January-May period after a 4 percent rise in the first four months of the year.

Lu Ting, chief China economist at Nomura, said that the increase in retail sales and slower fixed-asset investment growth underscore the shift in China's policy focus from investment to consumption.

However, he cautioned that the boost from the trade-in program may fade in the second half of this year, especially given the high base, while payback from the front-loading of exports might come after the 90-day truce period for the United States-China trade dispute ends.

For China to achieve its annual growth target of around 5 percent this year requires the rolling out of a sizable stimulus package, he said.

Wang Qing, chief macroeconomic analyst at Golden Credit Rating International, said, "We expect the central bank to continue cutting interest rates in the second half, while policymakers will likely introduce incremental fiscal policy measures to further support the trade-in program."

Wang also noted that the key to boosting consumption also lies in stabilizing the housing market, which will help offset external uncertainties, restore market confidence and support household spending.

Goldman Sachs recently reaffirmed its bullish view on China's stock market, saying that the medium-term investment outlook for China's private enterprises is improving.

In a report, Goldman Sachs also highlighted stocks with huge potential including those of Tencent, Alibaba, Xiaomi, BYD, Meituan and NetEase, which are all seen as leaders in their respective sectors and are expected to benefit from China's steady economic recovery.