Washington's trade policy fails basic math

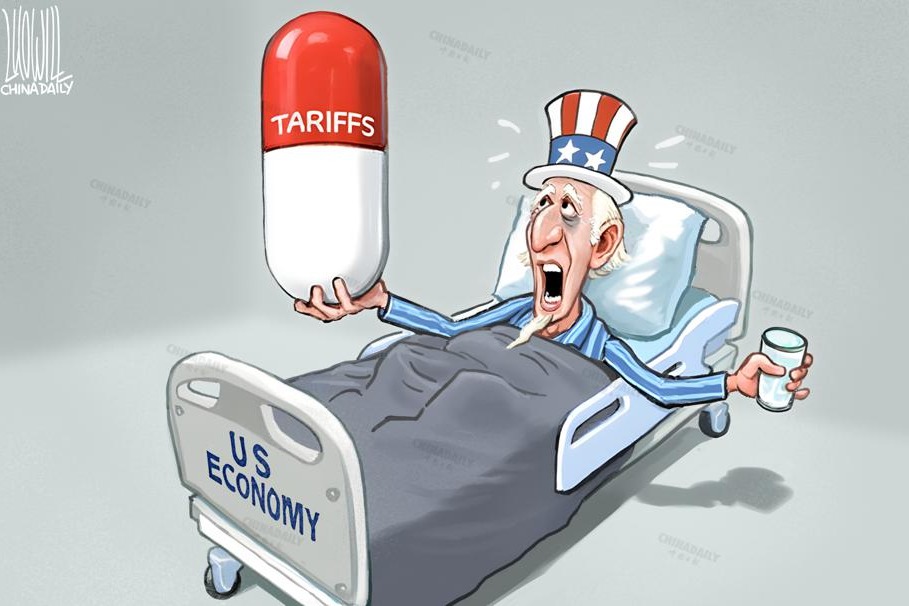

US President Donald Trump has increased additional tariffs on Chinese goods up to 125 percent, with the total rate to 145 percent, while China has taken countermeasures including additional 125 percent duties on American imports.

The US' policy shift reflects a deeper abandonment of strategic tradecraft. The new tariff regime is not based on credible economic modeling, enforcement of fair trade rules, or reciprocity. Instead, it is built on a formula that converts bilateral trade deficits into tariff percentages. The logic is: the bigger the deficit, the bigger the punishment.

But this framework ignores the real causes of trade imbalance — currency flows, global sourcing, labor specialization, and consumer demand. Trade deficits are not acts of aggression. They are the consequence of structural choices and market dynamics.

The US has had trade deficits for decades. But trade deficits have not weakened the US economy — deficits have coexisted with strong job growth, innovation and investment. The US dollar's global reserve currency status and high domestic consumption ensure persistent imbalances in goods trade. Tariffs cannot rewrite these fundamentals. They can only distort prices, disrupt supply chains, and strain diplomatic relations.

The latest wave of tariffs is also incoherent in its application. Vietnam, which levies on average less than 10 percent tariffs on US goods, has been hit with a 46 percent US tariff. The European Union, whose trade barriers are comparable to or lower than the US', received a flat 20 percent tariff penalty. Even the remote, uninhabited Australian external territory of Heard and McDonald Islands — home only to penguins, seals and seabirds, with no permanent human settlement or meaningful exports — was slapped with a 10 percent tariff. These actions are not strategic; they are algorithmic and devoid of context or logic.

Markets have responded accordingly. Bond yields have surged as investors brace for inflation, instability and retaliation. Multinational companies are freezing investment, delaying orders, and seeking ways to circumvent US customs. Far from reinvigorating domestic manufacturing, this policy has increased uncertainty and capital flight.

The impact of the tariffs on American consumers will be swift and severe. Analysts estimate the tariffs will raise average household costs by $3,800 a year. The products affected include daily necessities: smartphones, laptops, HVAC systems, clothing, medical equipment, and baby formula. Some small businesses are already shutting down. A solar panel enterprise in Arizona and a clothing start-up in Pennsylvania have warned they cannot absorb the price shocks. These are not isolated cases but early signs of a broad contraction.

Diplomatically, the consequences are equally severe. China's retaliatory tariffs will apply to all US exports, including aircraft parts, energy products, semiconductors and agricultural products. Canada and Mexico have imposed 25 percent tariffs on US goods in response. The European Commission is weighing slapping digital taxes on US tech companies.

Thanks to the tariffs, key allies now view Washington as unpredictable and vindictive. The tariffs have not isolated Beijing. They are isolating the US.

The 2018 trade war showed the limits of broad tariffs. While US steel enjoyed temporary protection, the wider US economy suffered. Many jobs were lost in the US due to the tariffs and retaliatory barriers. Most companies that left China did not return to the US; instead, they shifted to Vietnam, Mexico or other lower-labor cost countries. Prices rose. Supply chains broke. The promised manufacturing revival never materialized.

History has another warning. The Smoot-Hawley Tariff Act of 1930 raised duties on more than 20,000 goods, and many countries responded by imposing tariffs on US goods. Between 1929 and 1934, global trade declined by 66 percent, deepening the Great Depression. While Smoot-Hawley did not directly cause World War II, it weakened the global economy and fueled the rise of authoritarian regimes. Trade wars do not stabilize, rather they destabilize, the economy. They do not solve, but create more, problems.

There is a better path. A true industrial strategy means investing in automation, skilled labor, resilient infrastructure and regional supply chains. It means targeting critical sectors — semiconductors, clean energy and biotechnology — through coordinated public-private partnerships. It means working with allies to enforce rules and raise standards, not acting alone in ways that provoke retaliation and undermine trust.

The economic frustrations behind tariff populism are legitimate. But the tools now being used are blunt, ineffective and destructive. Tariffs of this scale are not precision instruments. They are political theatrics imposed without strategic clarity.

If the US wishes to remain a global leader, it must act like one. For that, it needs consistency, coordination, and credibility. None of these can be achieved through news conference ultimatums or spreadsheet-driven punishment. The US needs a policy grounded in facts, not fury.

It's time to abandon the politics of pain. The world is too interconnected, and the stakes too high, to make improvization to masquerade as strategy. The US must stop turning trade deficits into targets and turn shared challenges into solutions.

The world does not need more math. It needs leadership. Let's get the mission right.

The author is an IEEE and ASME fellow, chairman and president of Energy Policy and Security Associates, and a professor emeritus at the University of Minnesota. The views don't necessarily reflect those of China Daily.

If you have a specific expertise, or would like to share your thought about our stories, then send us your writings at opinion@chinadaily.com.cn, and comment@chinadaily.com.cn.